In the world of stocks, investors are constantly searching for promising companies and emerging trends that could deliver significant returns. One such company that has been generating increasing attention is DJT Stock. Whether you’re a seasoned investor or just starting to explore the stock market, understanding the performance and potential of DJT Stock is essential for making informed decisions.

In this comprehensive guide, we will delve into the key aspects of DJT Stock, including its performance, market trends, historical data, and future outlook. Additionally, we will explore the factors that impact its value and provide tips on how to invest wisely in DJT Stock. Furthermore, this guide will answer frequently asked questions (FAQs) to help you gain a deeper understanding of DJT Stock and its potential in the stock market.

1. What is DJT Stock?

DJT Stock refers to the shares or equities associated with a company, organization, or business entity that uses the ticker symbol “DJT” on a specific stock exchange. The ticker symbol for DJT represents the company’s trading identity in the stock market, providing investors with an easy way to identify and track the stock.

Before diving into the specifics of DJT Stock, it’s important to understand how stock ticker symbols work. Ticker symbols are typically made up of a combination of letters that represent a publicly traded company or fund. These symbols are unique identifiers and are used by investors, analysts, and market participants to quickly locate information about a stock.

While DJT Stock is not associated with a specific company that immediately comes to mind for many investors, its presence on various exchanges and growing relevance in market discussions are leading investors to take notice. This guide will explore the factors driving its rise, including business ventures, market strategies, and other key drivers that shape its performance.

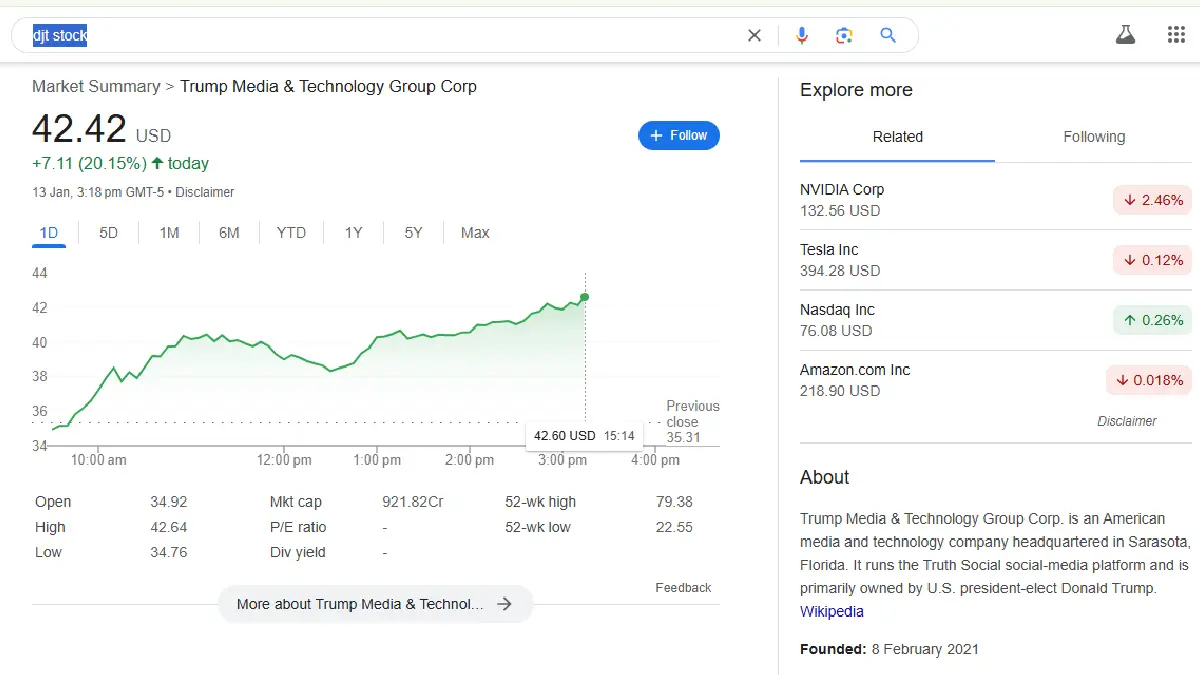

2. Performance of DJT Stock

The performance of DJT Stock is influenced by various factors, including the company’s financial health, market trends, economic conditions, and investor sentiment. In this section, we will look at the historical performance and current trends of DJT Stock, so you can make more informed investment decisions.

A. Historical Performance

The historical performance of DJT Stock provides valuable insights into its growth trajectory, market volatility, and overall stability. By analyzing past performance, investors can evaluate how the stock has fared during economic cycles, periods of uncertainty, and other significant events. This information helps investors assess the stock’s risk profile and make predictions about its future prospects.

DJT Stock has had fluctuations in its price due to market conditions, but it has shown resilience in adapting to changing business landscapes. The stock has also gained the attention of both individual and institutional investors, which has resulted in higher trading volumes and increased visibility in the marketplace.

B. Current Market Trends

To better understand DJT Stock’s future potential, it’s essential to keep track of current market trends. These trends can include various factors such as:

- Industry Trends: DJT Stock may be tied to specific industries that are currently experiencing growth, such as technology, healthcare, renewable energy, or consumer goods. Identifying these trends can help investors gauge the potential for the stock’s future growth.

- Market Sentiment: Investor sentiment plays a major role in driving stock performance. Positive news coverage, strong earnings reports, and investor enthusiasm can drive the stock price higher. Conversely, negative sentiment driven by scandals, poor earnings, or broader market conditions can negatively impact the stock’s performance.

- Economic Conditions: Economic factors such as interest rates, inflation, and global events can also influence the price of DJT Stock. For instance, a rise in interest rates may lead investors to seek safer assets, which could result in a decline in stock prices.

C. Key Financial Metrics

When evaluating the performance of DJT Stock, several key financial metrics are used to assess the company’s health. These include:

- Earnings per Share (EPS): EPS is a critical metric that helps investors gauge the company’s profitability. A higher EPS typically indicates a company is generating more income per share, which can positively affect the stock price.

- Price-to-Earnings (P/E) Ratio: The P/E ratio is used to evaluate whether the stock is undervalued or overvalued. A high P/E ratio suggests the market has high expectations for future growth, while a low P/E ratio may signal undervaluation.

- Dividend Yield: For income-focused investors, the dividend yield is an important metric. It shows how much income investors can expect from dividends relative to the stock’s price.

- Market Capitalization: Market cap is the total value of a company’s outstanding shares of stock. DJT Stock’s market cap can be a useful indicator of the company’s size and stability compared to other market players.

3. Investing in DJT Stock: Tips and Strategies

Investing in DJT Stock, like any other stock, requires careful planning and strategy. In this section, we’ll provide some essential tips and strategies to help you make the most of your investment.

A. Do Thorough Research

Before investing in DJT Stock, it’s crucial to conduct thorough research. Investigate the company’s business model, industry prospects, leadership team, financial health, and market conditions. The more informed you are, the better equipped you’ll be to make confident decisions regarding your investments.

B. Diversify Your Portfolio

Diversification is a key principle of successful investing. Rather than putting all your money into DJT Stock, consider spreading your investments across different asset classes and sectors. Diversifying your portfolio can help you manage risk and reduce the impact of potential losses.

C. Understand Your Risk Tolerance

Investing in stocks comes with a level of risk. It’s important to assess your risk tolerance before committing to DJT Stock. Determine how much risk you are willing to take and how it fits with your overall financial goals. If you are risk-averse, you may prefer a more conservative approach or choose to invest in lower-risk assets.

D. Monitor Market Conditions

Stock prices can fluctuate based on economic conditions, global events, and market trends. Regularly monitor these factors to stay informed and adjust your investment strategy accordingly. Stay up-to-date with news regarding DJT Stock, the industry it operates in, and the broader market to ensure you are making the best possible decisions.

4. The Future Outlook for DJT Stock

Looking ahead, DJT Stock has the potential for further growth, depending on several factors. Here are some aspects that may influence its future performance:

A. Innovation and Market Expansion

If DJT Stock is tied to a company that is actively pursuing innovation, expanding into new markets, or creating new products, this can lead to significant growth in the future. Companies that are forward-thinking and adaptable to market changes have the potential to thrive even in uncertain times.

B. Industry Growth

The industry in which DJT Stock operates plays a crucial role in determining its future success. If the industry is experiencing growth, such as in sectors like technology, healthcare, or clean energy, the stock may benefit from positive tailwinds.

C. Regulatory Changes

Government regulations can also affect the performance of DJT Stock. Positive regulatory changes, such as tax incentives for certain industries or favorable government policies, can boost investor sentiment and drive stock prices higher.

D. Competitive Landscape

Understanding the competitive landscape is also essential when assessing the future potential of DJT Stock. If the company is well-positioned to outperform competitors, it may gain market share, which can lead to higher stock prices and sustained growth.

5. Frequently Asked Questions (FAQs)

1. What is DJT Stock? DJT Stock refers to the shares of a company or business entity that trades under the ticker symbol “DJT” on the stock exchange. It represents the company’s presence in the stock market, providing investors with an opportunity to invest in its performance.

2. How can I invest in DJT Stock? To invest in DJT Stock, you need to open a brokerage account, deposit funds, and then place a buy order for the stock. It’s essential to research the stock before making an investment decision.

3. What factors impact the price of DJT Stock? The price of DJT Stock is influenced by factors such as the company’s financial performance, market trends, economic conditions, investor sentiment, and competition within its industry.

4. Is DJT Stock a good investment? Whether DJT Stock is a good investment depends on various factors, including your financial goals, risk tolerance, and the stock’s performance. Always do thorough research and consult with a financial advisor before making any investment decisions.

5. Can I earn dividends from DJT Stock? Some stocks pay dividends to their shareholders as a form of income. Check whether DJT Stock offers dividends by researching its dividend policy. Keep in mind that not all stocks provide dividends.

6. What is the P/E ratio of DJT Stock? The P/E ratio is a key financial metric used to assess a stock’s valuation. You can find the current P/E ratio of DJT Stock by checking the company’s latest earnings report or looking it up on financial news platforms.

Conclusion

DJT Stock is an intriguing option for investors looking to explore promising companies and emerging market trends. By understanding its historical performance, current trends, and future outlook, you can make more informed decisions about investing in DJT Stock. Remember to conduct thorough research, diversify your portfolio, and stay attuned to market conditions to maximize your chances of success. With the right strategy and careful planning, DJT Stock has the potential to be a rewarding addition to your investment portfolio.

Also Read:-

- UPSC Assistant Professor Recruitment 2025: Complete Guide for Indian Applicants

- 15 Upcoming Mobile Phones in India 2025: Complete Launch Guide & Expected Prices

- MPESB Recruitment 2025: How to Apply for Government Jobs

- Singapore Workers: How to Claim Your $3,267 Supplement

- December SSI Payment 2024: COLA Increase Boosts Benefits – New Payment Amounts Revealed